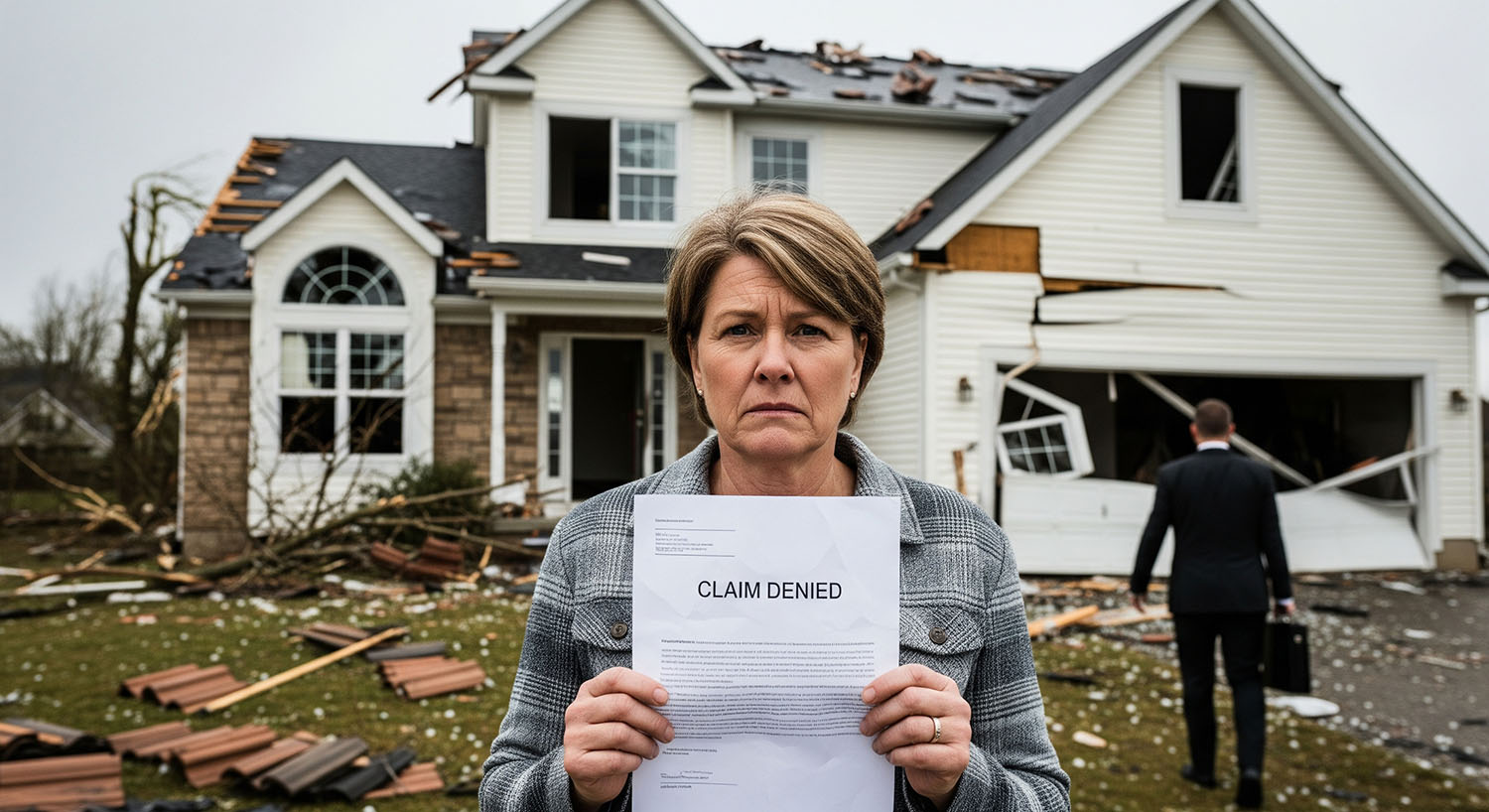

After a severe storm, the last thing you need is a dispute with your insurance company. Yet, for many homeowners in the Rio Grande Valley and along the coast, denied or drastically underpaid claims are a frustrating reality. This article breaks down the common tactics insurance companies use to avoid paying out, from claiming “wear and tear” to demanding excessive documentation. We’ll outline your rights as a Texas policyholder and explain why a claim denial is not the final word. Don’t let them lowball you—learn how to fight back and get the full compensation you are owed to rebuild your home.

It’s crucial to understand the subtle but significant ways insurers can devalue your claim. They often use outdated pricing models for materials and labor, fail to account for local building codes that require more expensive repairs, or overlook hidden damages like water intrusion and mold growth that are not immediately visible. This strategy of offering pennies on the dollar is designed to overwhelm you into accepting less than you deserve. By working with a law firm that specializes in Texas insurance law, you gain access to a team that knows these tactics inside and out. We partner with independent adjusters and experts to thoroughly document all of your property’s damage, leaving no stone unturned in our fight to get you a fair settlement.

The longer an insurance company delays your claim, the more financial and emotional distress you face. Texas law requires insurers to act in good faith and handle claims promptly. When they don’t, it may be a case of bad faith insurance. If your claim has been unfairly denied, drastically undervalued, or endlessly delayed, you have the right to challenge their decision. Our firm provides the aggressive legal leverage you need to force insurance companies to honor their commitments and pay what they owe. We’re here to take the fight to them, so you can focus on restoring your property and your peace of mind.